Property & Casualty Trends to Watch in 2023

Insurance experts often examine how outside influences and trends affect the insurance marketplace, and businesses should follow suit to determine what factors may impact their insurance coverage. For 2023, there are a number of sweeping market developments to consider.

Labor Shortages

The last few years have seen widespread labor shortages. According to a recent survey conducted by financial services company Provident Bank, 75% of businesses have been affected by current worker shortages. Although these shortages are impacting businesses across industry lines, data from the U.S. Bureau of Labor Statistics (BLS) confirmed that the industries experiencing the most substantial workforce struggles include transportation, health care, leisure and hospitality.

Several factors have contributed to these labor shortages. Primarily, the lasting ramifications of the COVID-19 pandemic have motivated many workers to reevaluate their employment priorities. In particular, a growing number of employees have sought arrangements (e.g., greater work-life balance, higher pay, more expansive benefits, flexible hours and remote capabilities) that allow them to better manage personal caregiving responsibilities, boost professional development, prevent burnout and minimize ongoing health and safety risks.

As such, various workforce movements emerged between 2021 and 2022, including the Great Resignation and the Great Reshuffle. The former, which occurred throughout 2021, was characterized by a high proportion of workers reassessing their job arrangements and opting to voluntarily exit the labor market altogether—whether this entailed retiring early or finding new business ventures. Amid this movement, BLS data showed that 4 million Americans quit their positions each month in the back half of 2021. The latter movement, which took place in 2022, consisted of a large share of workers leaving their jobs in search of more fulfilling roles, such as positions in different career paths or those in the same industry with more competitive compensation and benefits. In fact, according to the Provident Bank survey, more than two-thirds (69%) of businesses had job candidates decline opportunities because of better offers this past year.

Regardless of how the pandemic may shift and evolve, many individuals have permanently altered their job expectations and workplace priorities, placing new demands on employers. As a result, economists expect labor shortages to continue throughout 2023 and beyond—impacting businesses for the foreseeable future. Specifically, these shortages could contribute to overworked employees; diminished staff morale and well-being; reduced productivity and project delays; widespread skills gaps and associated project quality concerns (e.g., product liability issues); and increased workplace accidents and related injuries and property damage.

To help combat labor shortages, many businesses have adjusted their hiring and retention tactics. For example, the Provident Bank survey found that one-third (33%) of businesses recently revised their job perks and benefits (e.g., expanded tuition assistance, more paid time off, additional caregiving reimbursements, improved 401k offerings, and higher salaries and sign-on bonuses) to retain current employees and attract new talent, while more than half (57%) implemented new work-from-home or hybrid arrangements. Moving forward, businesses will need to remain innovative in meeting their employees’ shifting expectations and attracting talent.

Supply Chain Disruptions

Since the onset of the pandemic, a range of supply chain disruptions have taken place. The majority of these issues originally stemmed from increased demand for various items and materials amid a slowdown in production and a subsequent lack of availability during pandemic-related closures. However, even though businesses have resumed their normal operations and increased production levels, consumer demand for certain items and materials continues to outweigh inventory. Creating further supply chain bottlenecks, various international disruptions (e.g., congestion at global ports and geopolitical conflict), rising fuel and energy costs, extreme weather events, and an ongoing shortage of warehouse workers and truck drivers have slowed shipment and delivery times for high-demand goods.

These supply chain disruptions have impacted a number of industries. According to the U.S. Census Bureau, the sectors that have experienced the greatest supply chain difficulties include manufacturing, construction and retail. Additionally, a recent survey conducted by international software company SAP found that at least half of business leaders have experienced financial impacts stemming from supply chain bottlenecks since the start of the pandemic—including decreased revenue (58%), a greater need to leverage business loans (54%) and an inability to pay employees (50%). In response to these financial struggles, 61% of business leaders have had to implement wage or recruitment freezes, 50% have made staff reductions and 41% have increased the prices of their products or services.

Some economic experts believe these supply chain issues will continue into the summer of 2023 before eventually subsiding. With this in mind, it’s important for businesses of all sectors to prepare for potential supply chain disruptions in the months ahead. According to the SAP survey, some examples of steps that business leaders plan to take include adopting new supply chain technology (74%), introducing updated contingency plans (67%), prioritizing U.S.-based supply chain solutions (60%) and searching for more eco-friendly options (58%). Implementing such measures could make all the difference in remaining operational amid possible disruptions.

Inflation Issues

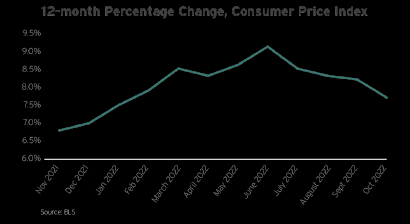

Over the past few years, the culmination of widespread labor shortages and supply chain issues has largely contributed to rising inflation concerns in the commercial insurance space. Yet, 2022 was a particularly troubling year for inflation, as evidenced by a surging consumer price index (CPI). According to BLS data, the CPI for all urban consumers increased by 9.1% year over year in June 2022, reaching a 40-year high. While the CPI cooled off in the following months, it still remained near record-setting levels, sitting at a 7.7% year-over-year increase in October 2022. Altogether, the elevated CPI has driven up claim costs for several lines of commercial coverage, therefore inflating total loss expenses across the property and casualty markets.

Within the property insurance space, the costs to repair, replace or rebuild structures and their contents after losses have soared, prompted by increased labor and material expenses. In fact, BLS data revealed a substantial year-over-year increase in the CPI for a number of property-related elements in October 2022—including floor coverings (12.8%), window coverings (3.7%), and furniture and bedding (8.3%). In the auto insurance market, vehicle repair expenses and subsequent accident costs have also surged, brought on by supply chain disruptions for several critical vehicle parts (and vehicles overall). These concerns were reflected in an increased year-over-year CPI in October 2022 for new vehicles (8.4%), used cars and trucks (2%), and motor vehicle maintenance (10.3%), according to BLS data.

Apart from rising CPI concerns, the workers’ compensation and liability insurance segments are also being affected by other forms of inflation—namely, medical and wage inflation. Medical inflation refers to increasing prices for health care necessities. These prices are usually determined a year in advance based on projections by Medicare and private insurance contracts. Since these projections occurred before the CPI skyrocketed, medical inflation has remained fairly low in comparison to overall inflation trends. As such, elevated liability claims and coverage costs stemming from medical inflation are expected in the year ahead.

Wage inflation, on the other hand, refers to workers’ increasing salaries. Amid continued labor challenges, many businesses have responded by boosting their workers’ pay, contributing to wage inflation. Because payroll is leveraged as an exposure base to calculate workers’ compensation premiums, wage inflation could prompt increased rates in this space. Further, such inflation may increase the risk of payroll miscalculations and create short-term disconnects between wages, benefits and workers’ compensation premiums. Most states have an index for wage inflation to make sure premiums and benefits keep up with each other, but it’s still possible for errors to occur.

To help curb overall inflation concerns, the Federal Reserve (Fed) has steadily been hiking up interest rates in recent months. Moving into 2023, economic analysts predict that the Fed’s efforts will eventually pay off, with inflation slowly subsiding throughout the year. According to investment banking company Goldman Sachs, the core price consumption expenditures index (CPE)—an inflation calculation utilized by the Fed that excludes food and energy prices—is currently at 5.1% but expected to drop to 2.9% by the end of 2023 (for reference, the Fed targets a CPE of 2% in a healthy economy). In the meantime, however, insurance carriers will continue to face inflation-related challenges as it pertains to maintaining coverage pricing to keep up with more volatile loss trends. Nevertheless, it’s important to note the insurance industry as a whole is better positioned to incur losses to its reserves than it was in previous periods of prolonged inflation in U.S. history (i.e., the 1980s).

Recession Risks

Some economic experts have forecasted that rising interest rates and prolonged labor market challenges could lead to a potential recession—a prolonged and pervasive reduction in economic activity—throughout the United States in the next six to nine months. Specifically, a recession will become increasingly likely in 2023 if the Fed has to continue raising its terminal policy rate—the level at which it will no longer boost interest rates—higher than initial estimates (5%-5.5%) to adequately mitigate inflation.

Amid a recession, businesses of all sizes and sectors usually experience decreased sales and profits stemming from changing consumer behaviors. Such an economic downturn may also limit organizations’ credit capabilities and reduce their overall cash flow as customers take more time to pay for products and services. As a result, when a recession occurs, businesses without substantial revenues, excess reserves and the additional capital necessary to offset extended periods of loss are more likely to have to make difficult financial decisions to avoid issues such as insolvency or bankruptcy. These businesses may need to cut operational costs and consider staff reductions to stay afloat.

The U.S. Census Bureau reported that nearly 1.8 million businesses closed their doors during the last major U.S. economic downturn, known as the Great Recession, which took place between 2007 and 2009. Looking ahead, a recent survey conducted by global professional services network KPMG found that the majority (86%) of business executives fear a recession will take place in the next 12 months. Fortunately, 60% of such executives anticipate this recession to be mild and brief. Regardless, now is the time for businesses to prepare for an economic downturn. According to the KPMG survey, more than 75% of executives confirmed their businesses already have recession-proofing measures in place. These measures may include establishing concrete financial plans to maintain profits, scaling back certain operations, promoting steady cash flow with shorter payment terms for customers, ensuring proper debt management, fostering strong connections with stakeholders and leveraging effective marketing strategies. Above all, it’s important for businesses to maintain ample coverage in a recession and secure financial protection against possible losses, as commercial risks tend to rise during such a downturn.

Social Inflation Concerns

In general, social inflation refers to societal trends that influence the ever-rising costs of insurance claims and lawsuits above the overall inflation rate. As the commercial insurance market shifts, it’s important to understand what’s currently driving social inflation.

Third-party Litigation Funding

One of the factors driving social inflation has to do with increased litigation or, more specifically, third-party litigation funding (TPLF). Such funding refers to when a third party provides financing for a lawsuit. In exchange, the third party receives a portion of the settlement. In the past, the steep cost of attorney fees would often scare plaintiffs away from taking a lawsuit to trial. But, through TPLF, most or all of the costs associated with litigation are covered by a third party, which has increased the volume of cases being pursued. Not only is TPLF becoming more common, but it also increases the cost of litigation, sometimes to seven figures. This is because plaintiffs can take cases further and seek larger settlements.

Tort Reform

Tort reform refers to laws that are designed to reduce litigation. In particular, tort reforms are used to prevent frivolous lawsuits and preserve laws that prevent abusive practices against businesses. Many states have enacted tort reforms over the last several decades, leading to fewer claims and caps on punitive damages. However, in recent years, a number of states have modified tort reforms or challenged them as unconstitutional. Opponents believe tort reforms lower settlements to the point where attorneys are less likely to take on new cases and help victims get justice for their injuries or other damages.

Further complicating matters, tort reform is subject to uncertainty, as it’s largely tied to political leanings and the interests of individual states. Should tort reform continue to erode, there could be fewer restrictions on punitive and noneconomic damages, statutes of limitations and contingency fees—all of which can drive up the cost of claims and exacerbate social inflation.

Plaintiff-friendly Legal Decisions and Large Jury Rewards

The overall public sentiment toward large businesses and corporations is deteriorating, and anti-corporate culture is more prevalent than ever. A number of factors are contributing to this increasing distrust, including the highly publicized issues related to the mishandling of personal data and social campaigns. This has had a considerable impact on how businesses are perceived by a jury in court, and organizations are held to a high standard for issues related to the way they conduct their business. In fact, juries are increasingly likely to sympathize with plaintiffs, especially if a business’s reputation has been tarnished in some way in the past. As a result, plaintiff attorneys are likely to play to a jury’s emotions rather than the facts of the case.

Compounding this issue, there’s an increasing public perception that businesses—particularly large ones—can afford the cost of any damages. This means juries are likely to have fewer reservations when it comes to awarding damages. In the current environment, nuclear verdicts (awards of $10 million or more) have become more common.

Extreme Weather Events

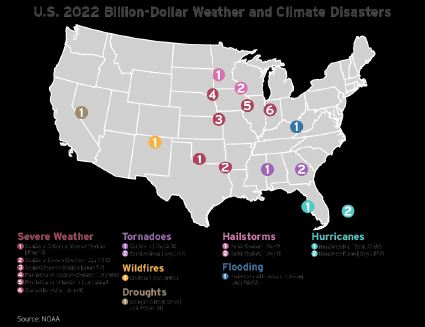

Extreme weather events—such as hurricanes, tornadoes, hailstorms and wildfires—continue to make headlines as they become increasingly devastating and costly. Making matters worse, these events aren’t limited to one geographic area or weather event, impacting businesses across the United States.

According to data from the National Oceanic and Atmospheric Administration (NOAA), wildfires again plagued the West Coast in 2022, recording a year-end total of more than 61,300 wildfires and burning 7.25 million acres. Widespread drought and several heat waves in the Western and Central United States contributed to the depletion of multiple large reservoirs (e.g., Lake Mead, Lake Powell, Lake Oroville and Shasta Lake), caused over 100 fatalities and cost at least $9 billion in damages. High winds and hundreds of tornadoes wreaked havoc across various Central, Southern and Eastern states, resulting in more than $10 billion in damages. A series of large-scale hailstorms—some of which even produced golf ball-sized hail—and a powerful derecho impacted states across the Midwest, contributing to more than $5 billion in damages. On the East Coast, the 2022 hurricane season recorded 14 storms, causing more than 200 fatalities, costing at least $110 billion in damages and affecting multiple states along the Atlantic Ocean.

One of the most devastating weather events from this past year was Hurricane Ian. According to the NOAA, this storm made landfall near Cayo Costa, Florida, in late September as a Category 4 hurricane, recording sustained winds of 150 mph. The storm traveled across the state’s barrier islands of Captiva, Sanibel, Pine and Fort Meyers Beach before moving to the inland communities of Orange, Volusia, Seminole and Brevard. Altogether, the storm resulted in severe property damage and widespread flooding throughout Florida, causing 10-20 inches of total rainfall in many areas. In the following days, the storm reemerged as a Category 1 hurricane, making landfall with sustained winds of 85 mph in Georgetown, South Carolina. The storm then produced significant coastal flood damage and destroyed several large piers along Myrtle Beach. As a whole, Hurricane Ian led to 131 fatalities and is expected to cost more than $100 billion in total damages.

Another notable weather event from 2022 was the historic inland flooding throughout Kentucky and Missouri. According to the NOAA, major flooding arising from a stalled frontal system in late July damaged thousands of residential and commercial properties, vehicles and other infrastructure across both states. Some communities recorded 10-12 inches of total rainfall, setting new flash flood records and requiring more than 600 helicopter rescues to evacuate individuals trapped by rising waters. Overall, such flooding caused 42 fatalities and cost more than $1 billion in damages.

Many weather experts believe severe storms, extreme temperatures, wildfires and flooding are the new norm. As these catastrophes become more frequent, the insurance industry will need to adopt innovative solutions to keep up with weather-related losses. Moving forward, businesses can expect to encounter additional emphasis on weather readiness from insurers.

Geopolitical Conflicts

This past year saw the emergence of severe international disruptions, particularly those relating to the ongoing Russia-Ukraine conflict. These types of global events have had far-reaching impacts, prompting new tariffs, export restrictions, economic sanctions, and subsequent surging fuel and energy costs in many countries. Further, such events have exacerbated existing inventory backlogs, material shortages and supply chain issues. Considering these developments, it’s no surprise that the latest industry research revealed more than one-fifth (21%) of businesses named war and terror as their top risk in 2022, up from 15% in 2021. As these events continue, businesses should prepare for potential disruptions and find ways to cut transportation costs by prioritizing fuel efficiency across their fleets, closely monitoring evolving global trade policies and considering domestic production solutions (e.g., switching from an international vendor or raw material to a U.S. alternative) to remain fully operational.

In addition to the previously mentioned impacts of international disruptions, these events have also led to heightened security concerns throughout 2022, including those related to nation-state cyberthreats. In response, a growing number of businesses have searched for insurance offerings that can help protect against potential cyberwarfare losses. Yet, securing adequate coverage for damages stemming from such warfare could prove particularly challenging, as war exclusions are commonly found in both commercial property and cyber insurance policies. Although these exclusions are fact-specific and often vary between policies and insurers, they generally state that damages from “hostile or warlike actions” by a nation-state or its agents won’t receive coverage. Such exclusions were created to help protect insurers against potentially systemic losses that may arise amid attacks by governments, their militaries or associated groups.

Over the years, some court cases have ruled in favor of policyholders seeking coverage under their commercial property or cyber insurance policies for damages resulting from cyberwarfare. These decisions are largely based on insurers failing to include clear language on digital warfare within their war exclusions. Following these rulings, insurers have made various adjustments to protect themselves from facing unanticipated claims and subsequent losses related to cyberwarfare. Primarily, insurers have become more apprehensive in selecting policyholders, utilizing extensive application processes and requiring insureds to provide detailed documentation on their cybersecurity practices. Furthermore, insurers are exploring ways to ensure their policy language—namely, the wording within war exclusions—provides clear and consistent guidelines for what is and isn’t covered, especially in the scope of digital warfare. As a result, it’s critical for insurers and insureds to openly communicate about policy definitions and specific coverage capabilities, especially regarding protection against digital warfare. Such communication will help ensure both parties are on the same page, minimizing potential issues when claims arise.

Source – Zywave, Inc.