Hard Market Conditions Intensify in Commercial Property

Hard market conditions of rate hikes coupled with tightening terms have intensified for June 1 renewals in commercial property, as carriers prevail in a “seller’s market” where new capacity remains scarce, sources told this publication.

Even clean accounts in the admitted space are seeing rate increases of 15% year on year, while loss-hit accounts in Florida were slapped with a 100% rate increase for June 1.

Rate increases were already in the double-digit range in March and April, when the degree of market hardening turned out to be far more acute than what was anticipated before the January 1 reinsurance renewals.

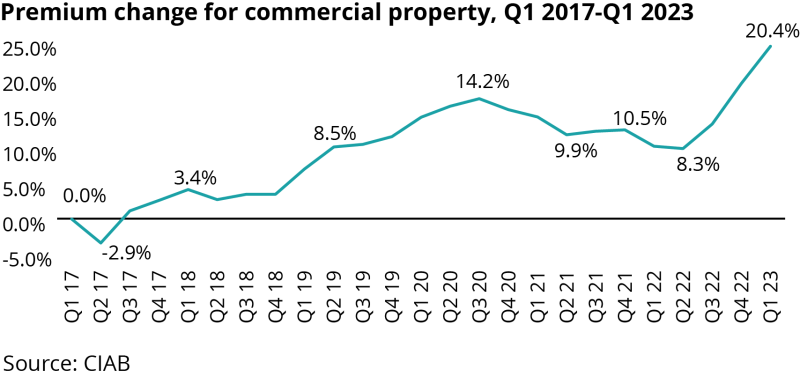

According to the Council of Insurance Agents & Brokers, US commercial property premiums spiked over 20% in Q1 2023 for the first time since 2001.

A big driver behind that hardening is reinsurance, as carriers are retaining more net capacity this year due to increasing costs and higher retentions.

Even facultative reinsurance, which covers a specific risk or a layer on a tower, has become hard to secure for cedants, sources said, increasing the prospect of underwriters taking more lower-return-period risk net.

Therefore, sources indicate that underwriters’ drive to obtain rate and tighten conditions will only increase through the year after the last batch of US property carriers’ reinsurance treaties renew on July 1.

“It’s going to be a continuous sharpening of the pencil – increasing rate, increasing deductibles and reducing capacity, all that is still going to be happening,” one property underwriter said.

The range of rate increases canvassed from sources budged up incrementally compared to April, but did not show a dramatic development, except in Florida.

While property rates can vary hugely by accounts, sources in the admitted market said that even non-cat, loss-clean accounts are getting a rate increase above 10%, with one underwriter citing 15% as the new minimum.

For loss-hit accounts or cat-heavy regions, the lower end of increases remained similar from April at 25%. But the higher end of that range moved up to 50% and above, according to sources.

In the E&S market, loss-exposed accounts were seeing figures from 40% up to 300%, whereas the minimum increase for clean accounts remained similar at around 20%. The first group not only pertained to cat-exposed regions like the Gulf Coast, but also certain industries like recyclers, old habitation or cold storage.

In Florida, rate increases even in the admitted market can be as high as “100% plus plus”, whereas rates for E&S renewals in the region are three times higher than any other Gulf Coast state like Louisiana or Texas, according to broker sources.

Capacity crunch

One factor sustaining the rate increase is a continuing capacity shortage. One broker said that line size reductions were still happening in the range of 10%-50% in the admitted market.

“Insurance companies cutting back by 50% is more common than you would think,” the source said, adding the trend has gotten a “little more aggressive” than earlier this year.

In E&S, carriers that had put out line sizes of $25mn last year or this year have now slashed them down to $5mn on average, according to a broker. “No one’s putting up more than five [million],” the source added.

A lot of sizeable providers of wind capacity have cut back significantly this year. One was AmRisc, which reduced its line size from $300mn to just $50mn following the exit of some paper providers, including AIG.

In addition, Hallmark Financial Group’s financial strength rating (FSR) was downgraded by AM Best to C++ (marginal) earlier this month, following the disclosure of an arbitration proceeding with Darag that will incur a loss of $25mn-$35mn. Later, the agency withdrew its ratings upon the carrier’s request.

Hallmark was not a dominant player in the E&S property space, but nonetheless its issues have effectively created another capacity void that other carriers have to fill, sources said.

On the demand side, the volume of business flowing to E&S from the admitted market continues to be more than what brokers and underwriters can deal with. But some sources also point out that clients are buying less limits simply because of affordability.

“There’s a lot of movement that we didn’t see much in March,” one E&S property executive said.

If the wind blows

Projections on how long the seller’s market will persist greatly varies.

Sources hopeful about the possibility of market conditions softening towards the end of the year raise the point that property valuations would have been corrected and that rate increases currently obtained by insurers would yield in better returns by then.

Another school of thought, however, argues that carriers, especially reinsurers, will need more than one good year to prove the business can be profitable to investors.

One E&S broker compared current times to previous hard markets, where reinsurance capacity had still been available for primary insurers.

“It was just a matter of pricing and things of that nature, but now, the lack of capacity is the major difference between previous years,” the source said.

But first, (re)insurers will have to pass their annual stress test: the 2023 hurricane season between June and November.

In a May outlook, the US National Oceanic and Atmospheric Administration forecast a 40% chance of near-normal hurricane activity in the Atlantic this year and a 30% chance of an above-normal season.

With 70% confidence in the ranges, it also predicted between 12 to 17 named storms, including five to nine becoming hurricanes and one to four becoming major hurricanes.

It remains to be seen if this will result in a mild loss-incurring year for property (re)insurers.

After all, the 2022 hurricane season also turned out to be a “near average” year in the end, with 14 named storms, eight hurricanes and two major hurricanes. It took only one of them to get the property market to where it is today.

Article Published By: Inside P&C

Article Written By: Kyoung-son Song, Senior Reporter, Inside P&C