Commercial Real Estate Trends to Watch in 2025

Insurance experts often examine how outside trends, reforms and movements in the larger economy affect the insurance marketplace, and businesses should follow suit to determine the factors that may impact their coverage. For 2025, there are a host of sweeping market developments to consider.

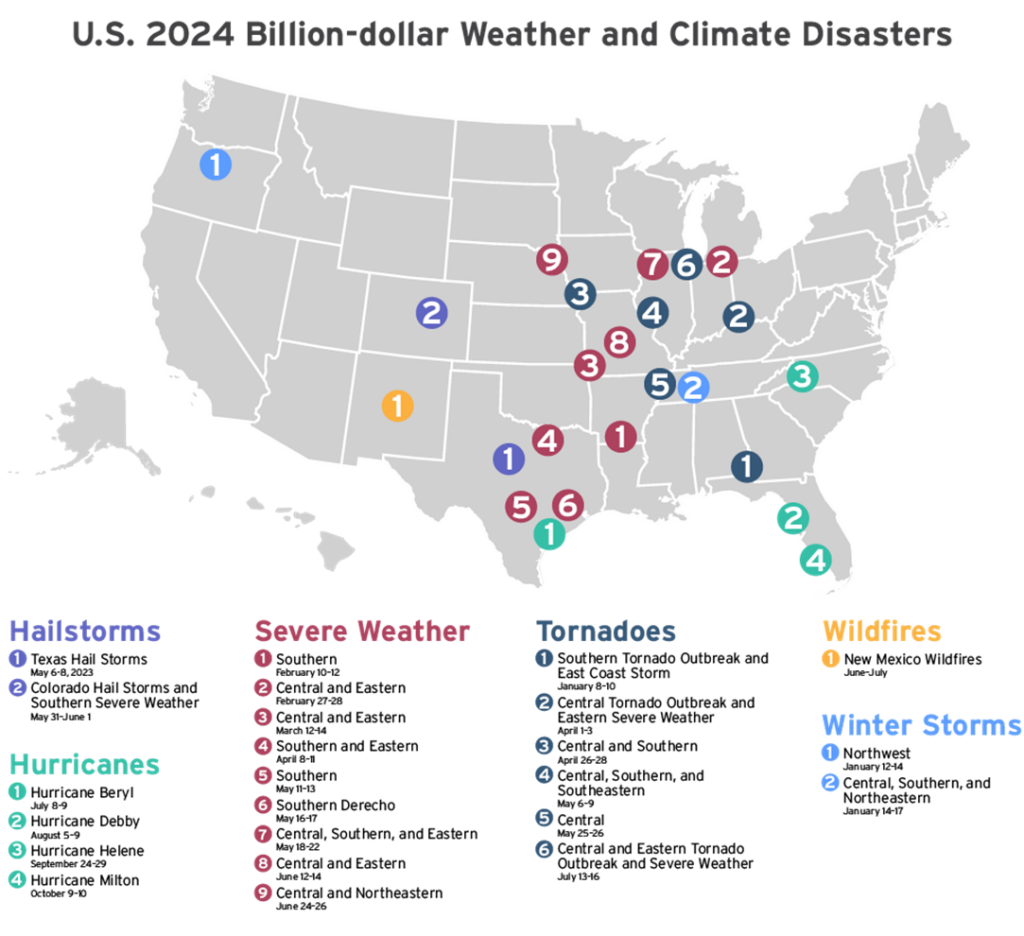

Extreme Weather Events

Extreme weather events—such as hurricanes, tornadoes, hailstorms and wildfires—continue to make headlines as they become increasingly devastating and costly. What’s worse, these events aren’t limited to one geographic area; they impact businesses across the United States.

In 2024 (as of Oct. 31), there were 24 weather and climate disasters in the United States where losses exceeded or were expected to exceed $1 billion. According to the National Oceanic and Atmospheric Administration, this included 17 severe storm events, four hurricanes, one wildfire and two winter storms.

Severe convective storms were a primary driver of losses from natural disasters, especially at the beginning of the year. The United States experienced a significant number of tornados, hailstorms and straight-line wind events, which resulted in over $30 billion in insurance claims. Further, the first half of 2024 was the second costliest on record in terms of losses from severe thunderstorms, and total losses hit $42 billion globally—87% higher than the 10-year average. Other notable events include the Texas panhandle wildfire—the state’s largest wildfire on record, which resulted in 426,600 hectares of fire damage—and two headline-stealing hurricanes: Hurricane Helene and Milton.

After making landfall as a Category 4 storm in Florida’s Big Bend region, Hurricane Helene sped inland with a path of devastation, bringing historic flooding, resulting in millions of power outages and causing more than 90 deaths in multiple states. Coming ashore as the strongest hurricane on record to hit the Big Bend region of Florida, Helene traveled an estimated 600 miles from Florida’s Gulf Coast through Georgia, North and South Carolina, and Tennessee. Initial reports suggested that nearly 162,000 commercial properties with estimated loss exposure of $425.9 billion lay in the projected path.

Hurricane Milton was equally devastating. The fifth hurricane to make landfall in the United States in 2024, Milton struck Siesta Key, Florida, on Oct. 9 as a Category 3 hurricane. With maximum sustained winds over 120 mph, Milton caused extensive storm surge and inland flooding damage. This was exacerbated by the fact that many areas hit by Milton were still recovering from damage caused by Hurricane Helene. Preliminary estimates place combined insured losses from Helene and Milton between $35 billion and $55 billion. However, attributing losses to each hurricane is challenging due to their close timing and overlapping impact zones, and it’s important to consider that final loss estimates could change.

Regardless, many weather experts believe severe storms, extreme temperatures, wildfires and flooding are the new norm. As these catastrophes become more frequent, the insurance industry must adopt innovative solutions to keep up with weather-related losses. Moving forward, businesses can expect to encounter additional emphasis on weather readiness from carriers.

Geopolitical Upheaval

This past year saw the continuation of severe geopolitical upheaval and international disruptions, particularly those relating to the ongoing Russia-Ukraine conflict, shifting trade dynamics between China and the United States, rising tensions amid the Israel-Hamas war and growing nation-state cyberthreats. These global events have had far-reaching impacts, prompting new tariffs, export restrictions, economic sanctions and coverage exclusions. Further, such events have exacerbated existing technological challenges, inventory backlogs, material shortages and supply chain issues.

Notably, the evolving conflict between Russia and Ukraine has severely hindered grain shipments from Black Sea ports. While a few of these ports remain fully operational, safe passage through the Black Sea isn’t guaranteed, further increasing disruption risks. Similarly, Houthi attacks off the coast of Yemen have disrupted shipping routes through the Gulf of Aden and the Suez Canal, which has impacted the supply of certain consumer goods (e.g., textiles, garments and furniture).

Disruptions like these have global consequences that can affect the price, availability and quality of products. In some instances, replacement items or construction materials are harder and more expensive to come by, which can significantly increase replacement costs. Experts suggest that supply chain disruptions could increase replacement costs for affected goods by an average of 7%. As these challenges persist, businesses should consider proactive measures like monitoring trade policies and exploring domestic production options to mitigate supply chain risks.

One of the most significant concerns associated with geopolitical upheaval is the extent to which losses stemming from international disruptions are covered by commercial insurance policies. In some cases, insurers are restricting coverage for insureds operating in regions engaged in conflicts or with high political instability. Some insurers have pulled out of these markets altogether or reduced capacity, making it difficult for certain businesses to secure adequate coverage.

Insurers are reevaluating their risk assessments and pricing models to account for geopolitical tensions, especially when it comes to cyber, political risk and marine insurance. As a result, insureds need to review their policies carefully and be mindful of potential exclusions. For example, war exclusions are common for both commercial property and cyber coverage. Although these exclusions are fact-specific and often vary between policies and carriers, they generally state that damages from “hostile or warlike actions” by a nation-state or its agents won’t receive coverage. Such exclusions were created to help protect carriers against potentially systemic losses that may arise amid attacks by governments, their militaries or associated groups.

To navigate these exclusions and reduce ambiguity on protection for nation-state cyberattacks, certain insurance marketplaces and carriers have recently revised their policy language surrounding war exclusions, thus providing more clear and consistent guidelines for what is and isn’t covered. Some carriers have also become more apprehensive about selecting policyholders, adopted extensive application processes, and introduced additional cybersecurity documentation requirements as a prerequisite for coverage.

Looking ahead, it’s essential for carriers and brokers to openly communicate with insureds about policy definitions and specific coverage capabilities regarding cyberwarfare. Such communication will help ensure both parties are on the same page, minimizing potential issues when claims arise. Furthermore, businesses should take a proactive approach to mitigating possible nation-state cyberthreats by implementing effective loss control measures (e.g., conducting risk assessments, reviewing digital supply chain exposures, addressing foreign attackers in cyber incident response plans, leveraging proper security software and following applicable government guidance).

Social Inflation Concerns

Social inflation refers to societal trends that influence the ever-rising costs of insurance claims and lawsuits above the general economic inflation rate. According to the National Association of Insurance Commissioners, the “social” aspect of this term represents shifting social and cultural attitudes regarding who is responsible for absorbing risk (i.e., the insurer or the plaintiff). As the commercial insurance sector shifts, it’s essential to understand what’s currently driving social inflation.

Third-party Litigation Funding

One of the factors driving social inflation has to do with third-party litigation funding (TPLF). This is when a third party provides financing for a lawsuit. In exchange, the third party receives a portion of the settlement. In the past, the steep cost of attorney fees would often discourage plaintiffs from taking a lawsuit to trial. But, through TPLF, most or all of the costs associated with litigation are covered by a third party, which has increased the volume of cases being pursued or taken further through the legal process. Not only is TPLF becoming more common, but it also increases the cost of litigation, sometimes to seven figures. This is because plaintiffs can take cases further and seek larger settlements.

Plaintiff-friendly Legal Decisions and Large Jury Awards

The public sentiment toward large businesses and corporations is deteriorating, and anti-corporate culture is more prevalent than ever. Several factors contribute to this increasing distrust, including the highly publicized issues related to the mishandling of personal data and social campaigns. This has considerably impacted how a jury perceives businesses in court, so organizations are held to a higher standard for issues related to how they conduct their business. Juries are increasingly likely to sympathize with plaintiffs, especially if a business’s reputation has been tarnished in some way in the past. As a result, plaintiff attorneys are likely to play to a jury’s emotions rather than the facts of the case.

Compounding this issue, there’s an increasing public perception that businesses—particularly large ones—can afford the cost of any damages. This means juries are likely to have fewer reservations about awarding damages. In the current environment, nuclear verdicts (jury awards of $10 million or more) have become more common.

The Ongoing Impact of Social Inflation

Social inflation continues to have a broad impact on the commercial insurance industry as 2025 approaches, driving increases in liability claims, legal costs and underwriting losses. In the last 10 years, social inflation has led to a 57% increase in U.S. liability claims. Further, due to social inflation, the cost to litigate a claim has risen substantially, with some figures indicating that legal defense expenses for businesses in the United States have increased by an average of 10% annually from 2018-23.

In 2023 alone, there were 27 court cases with awards of over $100 million. Higher legal defense costs and the overall liability environment can have significant repercussions for organizations and may even influence where a business chooses to operate. In some cases, these costs are passed down to consumers.

Social inflation has also contributed to overall underwriting losses. In particular, the U.S. commercial casualty market reported that overall losses grew at an average annual rate of 11%, totaling $143 billion in 2023. Additionally, over the past five years, U.S. liability lines subject to bodily injury claims have experienced $43 billion in underwriting losses.

Social inflation concerns have forced insurers to scale back capacity and limit coverage for businesses in industries prone to large court verdicts (e.g., trucking). Making matters worse, the unpredictability and cost of excess liability coverage have driven many insurers to exit the market, leaving some businesses vulnerable to devastating financial consequences in the face of a large settlement.

Still, insurers are cautiously optimistic going into 2025, especially given predicted premium and ROE growth. However, emerging risks—such as litigation related to opioids, microplastics, and per- and polyfluoroalkyl substances (or PFAS)—could create further uncertainty for insurers, so businesses must be tactful as they navigate ongoing social inflation pressures.

AI Developments

AI technology, which has surged in popularity in recent years, encompasses machines and devices that can simulate human intelligence processes. Applications of this technology are widespread, but some of the most common include computer vision solutions (e.g., drones), natural language processing systems (e.g., chatbots), and predictive and prescriptive analytics engines (e.g., mobile applications). According to the International Data Corporation, the market for AI technology and other cognitive solutions is projected to exceed $60 billion by 2025, up from $1 billion in 2015. In light of this growth, businesses must understand the benefits and ramifications of such technology.

AI systems can potentially improve loss control measures and claims management practices for several lines of commercial coverage. For example, AI can be utilized as a valuable safety tool to help mitigate workers’ compensation exposures and associated losses by way of providing prompt diagnoses when employees get injured on the job, generating customized treatment plans to improve recovery outcomes, selecting ideal health care providers, detecting injury patterns and anomalies, determining fundamental causes of workplace incidents and suggesting methods to prevent future losses, and reducing overall claim complexity. In addition, AI tools can help companies boost operational efficiencies through automated workflows, promote greater decision-making capabilities with predictive insights and conduct more effective due diligence processes in the boardroom. This technology could, in turn, reduce companies’ corporate exposures and related liability concerns. Further, carriers across coverage segments can leverage this technology to detect insurance fraud, assess policyholders’ unique risks and provide 24/7 assistance throughout claims processes.

Nonetheless, AI technology also carries risks for the commercial insurance space. For one, AI models may perpetuate or amplify biases in training datasets, leading to inequitable outcomes. Since this technology still relies on human algorithms, any inaccuracies or mistakes made during the initial input process could perpetuate companywide biases and produce serious errors amid corporate decision-making, exposing businesses to various lawsuits and related claims. The U.S. Equal Employment Opportunity Commission (EEOC) recently released detailed guidance for businesses regarding AI-related biases and errors in the workplace.

Using this technology in certain organizational settings may also pose ethical concerns regarding data privacy and protection. Generative AI is trained on data input, increasing the potential for breaches and unauthorized access to sensitive information. The way it collects, processes and shares data may also result in improper use of personal information, leading to regulatory fines and penalties.

What’s more, federal and state legislation surrounding AI technology is frequently changing, which means that companies that neglect to ensure compliance with applicable laws could face substantial legal penalties. On May 17, 2024, Colorado enacted Senate Bill 24-205, becoming the first state to pass comprehensive AI regulation. The law, effective on Feb. 1, 2026, will require businesses to use reasonable care to avoid discrimination when using AI for consequential decision-making (such as hiring, termination and other employment decisions). Insureds can expect similar legislation in other states to become more commonplace.

Lastly, cybercriminals have increasingly weaponized AI technology, exacerbating cyber losses and related claims among businesses. Primarily, cybercriminals can utilize this technology to carry out harmful activities (e.g., launching malware and social engineering scams, cracking passwords, finding software vulnerabilities and reviewing stolen data) at a rapid pace and with greater success rates, allowing them to cause major damage and even evade detection. Considering these issues, it’s best for businesses to carefully review the pros and cons of AI technology and establish adequate risk management techniques before implementing such solutions within their operations.

AI liability is a real threat—one that’s only going to grow as more businesses across all industries are adopting and deploying AI solutions. Claims can arise for a myriad of reasons, including AI-related errors and biases. For businesses that use AI in autonomous vehicles or to make business decisions, the risks are even more dire, as this technology introduces potential safety, cybersecurity and financial exposures. Given these issues, there is a continued push for innovation related to AI insurance products.

Currently, AI-related insurance focuses on liabilities that stem from the use and development of AI systems (e.g., errors and omissions by AI systems, cybersecurity breaches caused by AI vulnerabilities and product liability claims related to AI-powered products). As AI technology advances and becomes more integrated into various aspects of society, the demand for insurance coverage will likely expand. Potential future coverage areas could include liability for AI-generated misinformation or defamation, coverage for physical damage caused by autonomous systems (e.g., drones or robots), and protection against discrimination or bias resulting from AI decision-making.

Reinsurance Optimism

Reinsurance refers to an agreement to help insurance carriers transfer a portion of their risk exposure to a third party. Through reinsurance agreements or treaties, primary insurers can mitigate financial risks, improve solvency and expand their underwriting capacity, enabling them to offer more coverage and absorb losses from unforeseen events. The reinsurance sector plays a crucial role in stabilizing the insurance sector by helping primary insurers manage volatility from high-impact losses.

In recent years, however, the reinsurance segment has faced substantial challenges. Specifically, increasing demand for reinsurance products and an increase in CAT losses have led reinsurers to make significant payouts, impacting their overall profitability and creating challenging conditions across multiple lines of coverage. Consequently, many primary insurers have seen their reinsurance costs increase over the last few years, contributing to hardened market conditions.

The commercial property reinsurance space has been hit the hardest by these trends, largely due to the increased frequency and severity of extreme weather events and associated CAT losses. These conditions have contributed to primary insurers increasing rates and limiting capacity for commercial property insureds, highlighting the trickle-down effect of reinsurance challenges.

Going into 2025, expectations are mixed regarding reinsurance pricing trends. According to a recent survey from Fitch Ratings, more than half of respondents expect global reinsurers to raise prices for January renewals. Specifically, 30% of the insurance professionals surveyed predicted price hikes of over 5%, and another 26% forecasted moderate increases. Conversely, 22% of respondents anticipate price decreases, and Fitch Ratings believes that reinsurers are well positioned to maintain strong profitability and, in 2025, expect margins to stay near their 2023-24 peak.

Despite the optimistic outlook, there are concerns from reinsurers that rate increases in 2024 have not been sufficient to address rising loss costs, especially given CAT loss trends. Driven by Hurricanes Helene and Milton, global insured losses for 2024 are expected to exceed $100 billion for the fifth consecutive year. Given these substantial losses, property catastrophe insurance rates are unlikely to dip for 2025 as both primary insurers and reinsurers adopt more stringent underwriting practices to manage sustained risks in the reinsurance market.

Economic Pressures

Surging inflation has been a persistent concern in the commercial insurance space over the last few years, resulting in eroding investment income, higher administrative costs among carriers, increased claim expenses and rising premiums. Such inflation reached a peak in 2022, evidenced by the highest consumer price index (CPI) in 40 years.

Although inflation began to cool throughout 2023 and 2024, and the CPI rose just 2.4% year over year in September 2024, core CPI forecasts a possible stabilization near 2.5% by mid-2025. Outside factors—like strong wage growth in service industries, rising oil and shipping costs and consistently high housing costs could still exert upward pressure on inflation.

Medical Inflation

Medical inflation, encompassing costs related to medical treatment, hospital visits, medical equipment and health care labor, is projected to rise in 2025, driven by higher prescription drug costs, increased demand for mental health care, and health care wage growth amid labor shortages. PricewaterhouseCoopers Health Research Institute projects medical costs to increase to the highest levels seen in 13 years—8% in the group market and 7.5% in the individual market for 2025. State medical fee schedules can help stabilize costs but may not be sufficient to offset inflation impacts on workers’ compensation insurance, where medical severity trends and increased use of high-cost medications are closely monitored.

Wage Inflation

Wage inflation, which refers to workers’ rising salaries, rose 4.8% from March 2023 to March 2024, per U.S. Bureau of Labor Statistics data. Because payroll is leveraged as an exposure base to calculate workers’ compensation premiums, wage inflation could prompt increased rates in this space. Further, this form of inflation may increase the risk of payroll miscalculations and create short-term disconnects between wages, benefits and workers’ compensation premiums. Most states have an index for wage inflation to ensure premiums and benefits match one other, but errors can occur.

Federal Reserve Actions and Risk Management

To address inflation concerns, the Federal Reserve increased interest rates between 2022 and mid-2024 to stabilize inflation after it peaked in 2022. These rate hikes were successful, as inflation dropped closer to the Fed’s target, reaching 2.4% by September 2024. Considering improving inflation metrics, the Fed made a 0.5% rate cut in September 2024, with financial markets anticipating additional cuts. Despite recent cuts, some financial pressures remain as rates stay relatively high, impacting debt costs and credit availability.

As such, businesses should have adequate risk management measures in place. These measures may include establishing concrete financial plans to maintain profits, scaling back certain operations, promoting steady cash flow with shorter payment terms for customers, ensuring proper debt management, fostering strong connections with stakeholders and leveraging effective marketing strategies. Above all, businesses must maintain sufficient insurance and secure financial protection against possible losses, as certain commercial exposures tend to rise during such a downturn.

Remote Work

In recent years, many employers have revamped their remote and hybrid work arrangements. Whether it’s to reduce operating costs, create a better work-life balance for employees or maintain workplace policies that arose from the COVID-19 pandemic, telecommuting has largely become the new normal—or at least more commonplace—for many businesses across different industries.

These arrangements can lead to increased productivity, fewer costs (particularly as it pertains to real estate, absenteeism and relocation), and improved flexibility and workplace perks. Although implementing a work-from-home program can provide a wide range of benefits for businesses, allowing staff to work remotely also comes with unique risks and challenges employers may still need to navigate in 2025.

Cybersecurity Risks

Employees working from home may lack the same security protections they have in-office, leaving them more vulnerable to cyberattacks. This could result in data breaches with costly consequences for an organization. Employers can mitigate these risks by implementing policies for VPN use, requiring multifactor authentication and providing company devices with up-to-date security software. Educating remote employees on safe practices—such as avoiding public Wi-Fi for work—can also reduce cyber risk.

Workers’ Compensation Liability

Remote work also presents potential workers’ compensation concerns. When injuries occur in the home instead of on-site, there often isn’t a witness to verify that the incident occurred while the employee was performing company duties and not while working on personal tasks around the home. Complicating matters, when employees live and work across state lines, determining the jurisdiction for workers’ compensation claims and ensuring compliance with varying state laws becomes increasingly complex. To address these issues, employers should ensure their policies cover home office injuries and clarify what qualifies as a work-related injury under workers’ compensation laws.

Privacy and Compliance

There are also several compliance considerations to keep in mind. Employees should be made aware of their privacy rights when working from home. Just because work is performed on a home computer doesn’t mean it’s exempt from being monitored or inspected by the employer. Employers should communicate any monitoring policies transparently and, when necessary, secure employee consent to ensure compliance with privacy laws.

Article Published By: Zywave, Inc.