Buy-Sell Life Insurance

After putting considerable time and effort into building a business, you don’t want to risk it falling into the hands of someone who may not care for it. A buy-sell agreement is a contract among business owners that, upon the death of one of the owners, requires the remaining owners or the company itself to purchase the deceased’s interest according to agreed upon terms of the contract. In addition, the deceased’s heirs are required to comply by selling their inherited interest at a previously agreed-upon price.

Types of Buy/Sell Agreements

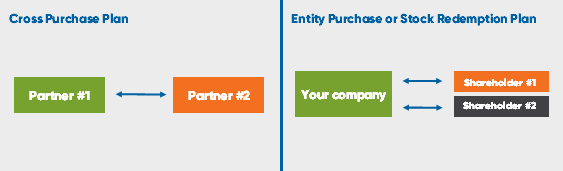

Cross Purchase Plan—A cross purchase agreement depends on each business owner buying a life insurance policy on each of the owners. Then, when an owner dies, the remaining owners use the payout from the life insurance policy to buy the deceased owner’s share of the business.

Entity Purchase or Stock Redemption Plan—Each employee-owner enters into an agreement with the business to sell their interest in the business. As part of the agreement, the business buys life insurance policies on the lives of each owner. The business pays the premiums and therefore exists as the owner and beneficiary of the policy. When an employee-owner dies, that share of the company passes to the heirs of his or her estate. Then the business can use the policy’s death benefit to buy the interest from the estate.

Potential Business Benefits of a Buy-Sell Agreement

A buy-sell agreement gives employers peace of mind knowing that their business is in capable hands should they no longer be able or want to manage it. It also:

· Provides money to create a fair market value exchange

· Promotes equitable and orderly transfer of wealth, ownership and management

· May offer tax advantages

· Guarantees heirs a buyer for assets they may not know how to manage

· Provides heirs cash to pay estate debt, expenses and taxes

Potential Benefits for Business Partners and Employees

For employees, a buy-sell agreement provides a way to purchase a business they have a vested interest in but may not have the capital for. It also:

· Assures remaining owners that the deceased’s share of the business will not pass on someone unsuitable

· Assures continuity for customers, creditors and employees

How a Buy-Sell Funded With Life Insurance Works

Considerations for the Business

A buy-sell agreement gives employers peace of mind knowing that their business is in capable hands should they no longer be able or want to manage it. It also:

· Provides money to create a fair market value exchange

· Promotes equitable and orderly transfer of wealth, ownership and management

· May offer tax advantages

· Guarantees heirs a buyer for assets they may not know how to manage

· Provides heirs cash to pay estate debt, expenses and taxes

Considerations for the Owners

· A buy-sell agreement establishes a ready market for the business interest.

· A buy-sell agreement allows for the orderly transfer of ownership.

· Proceeds received from the buy-out may provide estate liquidity to offset debt, expenses and taxes. It may also provide a valuable income stream for loved ones.

Buy-Sell Agreement Triggers

Many events can cause a buy-sell agreement to go into effect, and it’s likely that each of these events will require slightly different sale conditions. Buy-sell agreements will usually specify

restrictions and limitations for a variety of these triggering events in order to plan for all possible situations. Some events that might trigger a buy-sell agreement include the following:

· Death

· Disability

· Retirement

· Divorce

· Resignation

Determining Business Value for a Buy-Sell Agreement

One of the most difficult parts of setting up a buy-sell agreement is determining how much your share of the business is worth. This requires maintaining a delicate balance of the compensation you or your family will receive for your share, while also giving your co-owners a fair price. Setting a dollar amount for your business interest in advance of an actual sale helps determine the most objective price for all. Consider the following valuation methods for your buy-sell agreement:

· Prices for comparable businesses in your market

· Value of business assets, including liquidation value

· Historical earnings

· Future earnings

· Combination of business assets and earnings

Funding a Buy-Sell Agreement

There are various options for funding a buy-sell agreement, but some carry more risk than others. Some owners choose to open a company savings account in order to pay cash if the death of an owner occurs. The main problem with this strategy is the uncertainty of the future: what if a

catastrophe happens the next week, or even the next year? Relying on this savings account

presupposes that nothing will happen to the owners for many years while money accumulates in the account. Another option, which also carries heavy risk, is to wait and simply take out a loan if something happens to one of the owners.

An option that carries less risk is using life insurance to fund a buy-sell agreement. It ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free. In addition, the funds used to buy the deceased’s share are purchased for

pennies on the dollar and the premiums will likely be significantly lower than the cost of repaying loan interest.

When choosing the amount of insurance coverage needed to fund a buy-sell agreement, the coverage on your life should equal the value of your ownership interest. This ensures that when you die, there will be enough funding from the policy to pay for your full share of the business.

To learn more about all of your options please contact CMR Risk & Insurance Services.

Source – Zywave, Inc.